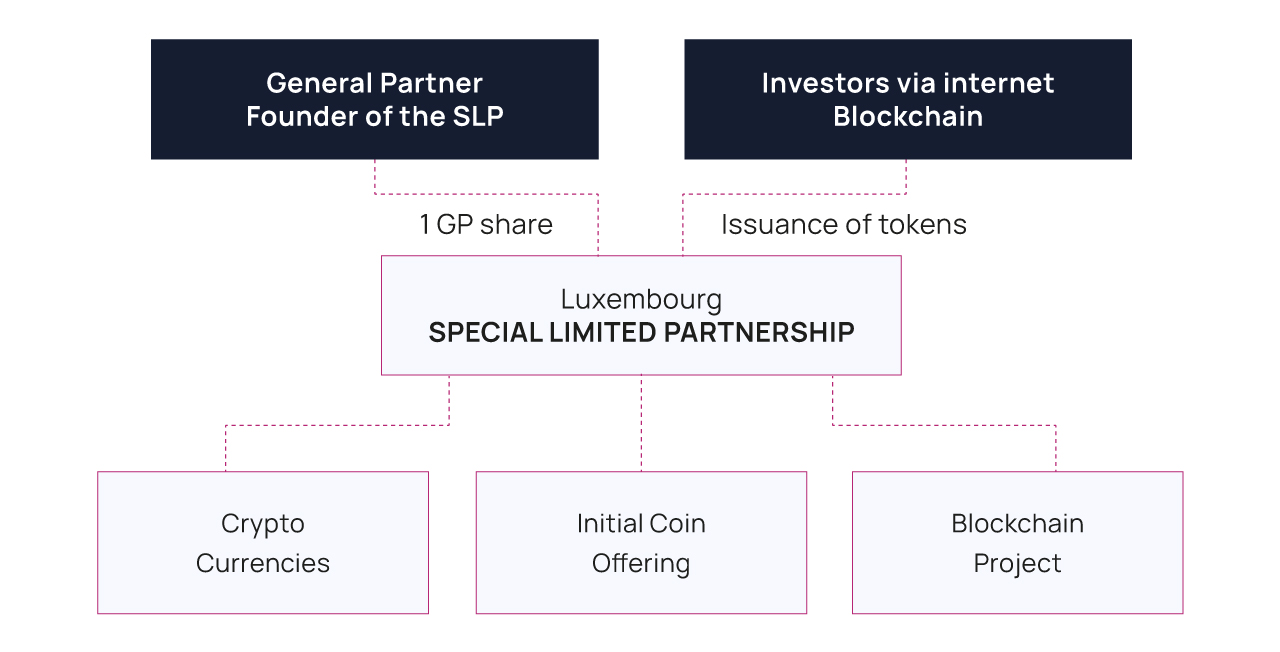

The SLP can be used to setup up a Crypto Fund as an Alternative Investment Fund

With the rise of the crypto currencies, investment managers have created Alternative Investment Fund to invest or trade crypto currencies (ETH, BTC, etc), to grant loan to traders, to invest in companies active in this sector, staking, etc.

Such so-called Crypto Funds can be setup as an unregulated Special Limited Partnership within a couple of weeks and remain unregulated if their manager’s AUM remains below 100 Mio eur.

Such Funds can also invest in “Tokens”, participate in ICOs, SAFT, invest in companies active in the Blockchain industry (private or public).

The SLP (Special Limited Partnership) is a flexible and fast solution for Alternative investment strategies.

Initial Coin Offering (STO) Process:

An ICO / STO is a fundraising method, operating via the issue of digital assets exchangeable against cryptocurrencies (or fiat money ) during the start-up phase of a project .

The issuer prepares a White Paper which consists of a document in which the underlying project is explained by its promoter.

Components of an offer:

- Project details

- Project timelines

- Amount of capital required

- Tokens (financial instrument)

- Dividend to be paid per token to investors

The next stage is the marketing campaign in which the issuer will promote their project to reach the initial capital.

BLOCKCHAIN TECHNOLOGY

Creatrust provides promoter with advisory services which include:

Fund setup and incorporation

Structuring crypto notes

Clearing with Clearstream/Euroclear

Central Administration services

N.A.V Calculation

AML/KYC and reporting

Access to our platform FundNav.lu

Read also: